Top Guidelines Of Estate Planning Attorney

Top Guidelines Of Estate Planning Attorney

Blog Article

Estate Planning Attorney Can Be Fun For Everyone

Table of ContentsEstate Planning Attorney Can Be Fun For AnyoneAbout Estate Planning AttorneyLittle Known Facts About Estate Planning Attorney.5 Easy Facts About Estate Planning Attorney Shown

A strong estate plan will certainly secure your possessions and permit you to pass on as much of your estate as possible.

It appears laborious however it is essential to speak with all your capacity attorneys, because estate preparation is an individual process. You will be sharing personal information regarding your money and your strategies for the moment of your fatality. Having a strong attorney-client relationship will make things a great deal much easier. Exactly how long have you been exercising? Where were you enlightened in legislation? Exactly how will we call each various other? Will I be able to reach you directly or will somebody else be my point of get in touch with? Will you send me updates on my estate plan in the future or is this an one-time service? How will you charge me (per hour vs fixed rate), and what is your rate? Exist any costs not included in that rate? If you're collaborating with an estate lawyer from a huge law practice, it is essential to recognize if you will certainly function specifically with one individual.

Estate Planning Attorney - The Facts

Attempt to chat with people that have collaborated with the lawyer, like their customers or even another lawyer. Lawyers who are tough to deal with or that treat individuals improperly will likely create such a reputation swiftly with their peers. If required, have a follow-up discussion with your potential estate lawyer.

When it concerns ensuring your estate is prepared and taken care of effectively, employing the ideal estate planning attorney is essential. It can be harmful to make such a huge decision, and it is very important to know what questions to inquire when taking into consideration a law office to manage your estate intending job.

You'll ask about the devices readily click here for more info available for helpful site thorough estate strategies that can be tailored to your distinct situation. Their credentials for exercising estate preparation, their experience with special research study tasks connected to your particular task, and exactly how they structure their payment versions, so you have appropriate expectations from the start.

Getting My Estate Planning Attorney To Work

It is very important to keep in mind that estate planning records are not just for well-off people; every person must consider contending least a basic estate plan in position. With this being stated, it's necessary to recognize what obligations an estate preparation attorney has to make sure that you can discover one who fulfills your distinct needs and goals.

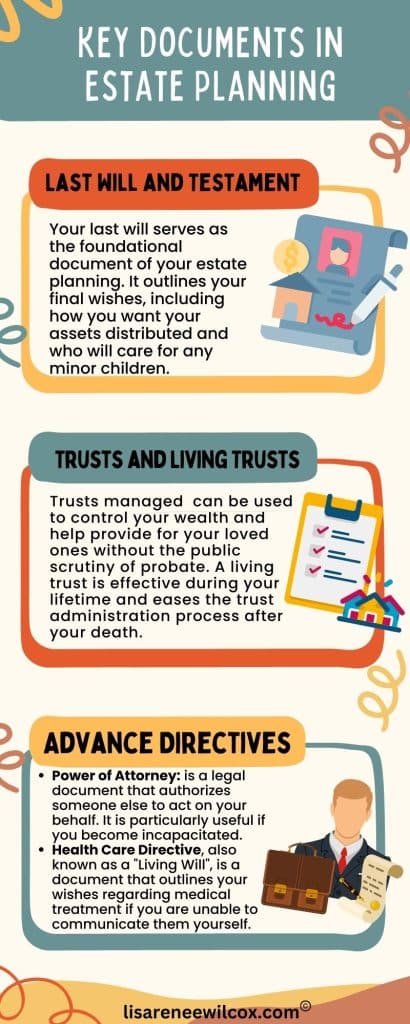

This entails assisting the customer recognize their assets and obligations and their desires regarding the distribution of those possessions upon fatality or incapacitation. The estate preparation lawyer will certainly assess any kind of existing documents that the customer might have in area, such as wills, trusts, and powers of attorney, to ensure they are up-to-date with state laws.

In addition, the estate planning attorney will deal with the client to evaluate their tax circumstance and suggest methods for minimizing tax obligations while additionally attaining the preferred goals of the estate strategy. An estate planning attorney ought to be consulted whenever there are any modifications to an individual's monetary situation or family framework, such as marital relationship or separation - Estate Planning Read Full Report Attorney.

With all these duties in mind, it is essential to understand what credentials one must try to find when selecting an estate organizer. When choosing an estate planning legal representative, it is necessary to make sure that they are qualified and experienced. Several estate planning attorneys have actually years of specialized training in the field and experience functioning with customers on their estate plans.

The Single Strategy To Use For Estate Planning Attorney

Experience and know-how are essential when selecting an estate planning lawyer, but there are other considerations. Some lawyers may specialize in particular areas, such as elder regulation or business succession preparation, while others might be much more generalists. It is additionally important to take a look at the recommendations offered by the lawyer and any kind of evaluations they have received from previous customers.

This will certainly permit you to understand their character and experience degree and ask inquiries concerning their method and strategy to estate preparation. By asking these questions ahead of time, you will certainly much better comprehend how each lawyer would handle your situation before devoting to collaborate with them on your estate plan. You need to ask the appropriate concerns when choosing an estate preparation lawyer to ensure that they are the very best suitable for your requirements.

When choosing an estate preparation attorney, it is very important to comprehend what kinds of solutions they provide. Inquire concerning the lawyer's specific estate planning solutions and if they can produce a personalized estate plan customized to your demands. Ask if they have experience creating living trust fund records and various other estate planning instruments such as powers of attorney or health and wellness care directives.

Report this page